To list, or not to list- that is the question. Here you are, ready for some Prime sales. But if you start shipping now, how much are you really paying Amazon for every sale you make? And what about tax? We’ve got Amazon fees and taxes explained for you in plain English, so keep on reading.

Based on recent Statista figures, Amazon is the USA’s leading e-commerce company. So, it’s no wonder that it attracts sellers of every background from across the world. But many Amazon sellers are not aware of the fees and taxes it charges, which can sometimes add up and take them by surprise.

We’ve gone over the 10 Hidden Costs of Selling on Amazon before. In today’s post, we provide a brief overview of the most important Amazon fees and taxes, how they are calculated, and how they can affect your profit margin. Then we’ll round off with some tips on how to avoid unexpected charges.

Amazon Fees and Taxes Explained

Core Amazon Seller Fees

Seller fees are the sine qua non of any guide on Amazon fees and taxes. These subscription, referral, and fulfillment fees can vary depending on the product category, the amount of sales, selling history, etc. Below is a synopsis of all the key seller fees, as discussed in How Much Does It Cost to Sell on Amazon:

a. Selling Plan

Amazon charges every merchant a selling fee. You can either pay $0.99/item on a pay-as-you-go-basis or opt for the Professional plan and pay $39.99/month. You’re free to toggle between the Individual and the Professional plan, but the latter is the default setting for new accounts.

Both options grant you access to FBA. But Professional sellers have all the perks. You can add users to your account, sell in several categories, offer free shipping, advertise, list in bulk, manage unified accounts Also called an Amazon European Ma… More, access Buy BoxThis refers to the situation where a sel… More perks, and use API to integrate with Amazon and streamline your sales.

b. Amazon Referral Fees

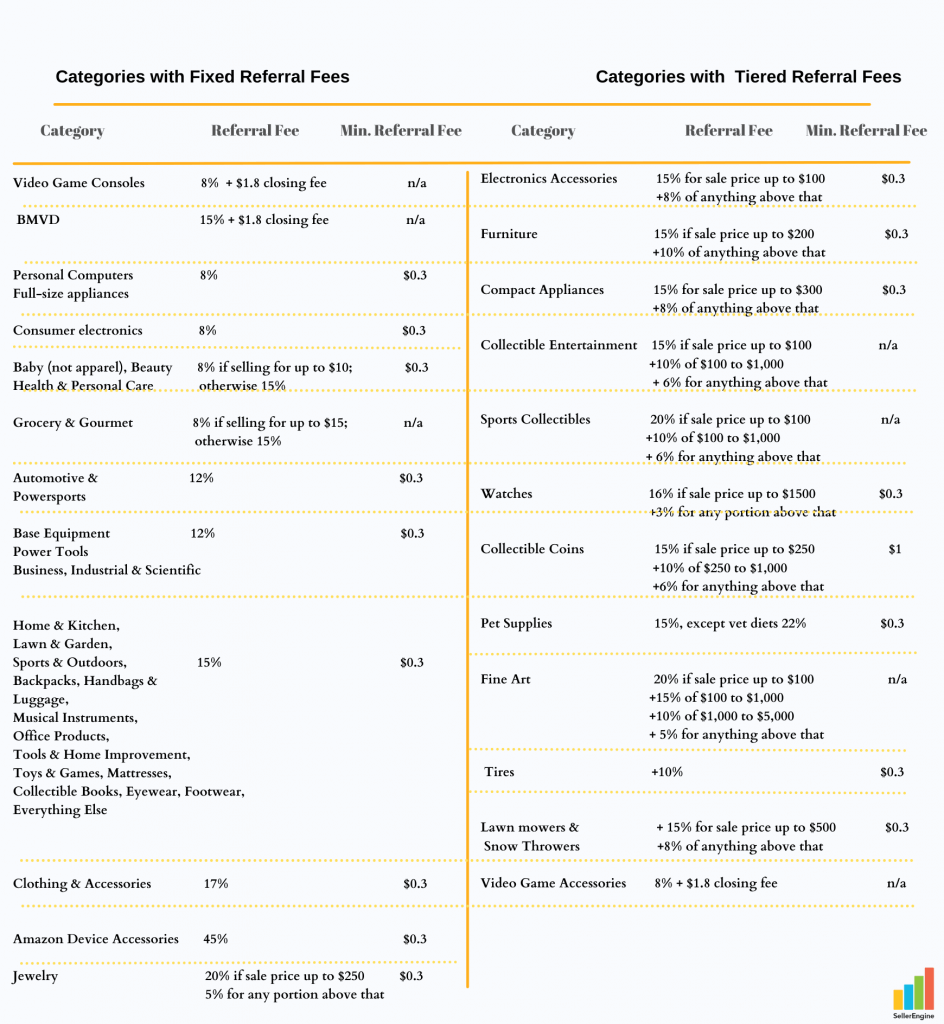

You’ll pay Amazon a finder’s fee for every item you sell. It depends on the category and the marketplace, it can be fixed or tiered, and it’s based on the total price (item price + shipping cost + gift wrapping).

Referral fees range from 6% to 46%. But the typical fee is 15% or $0.3, whichever is greater. For Books, Media, Video, and DVD (BMVD) items, a closing fee of $1.8 will also apply. Also note that some categories and products are restricted and may require ungating fees.

c. Amazon Fulfillment Fees

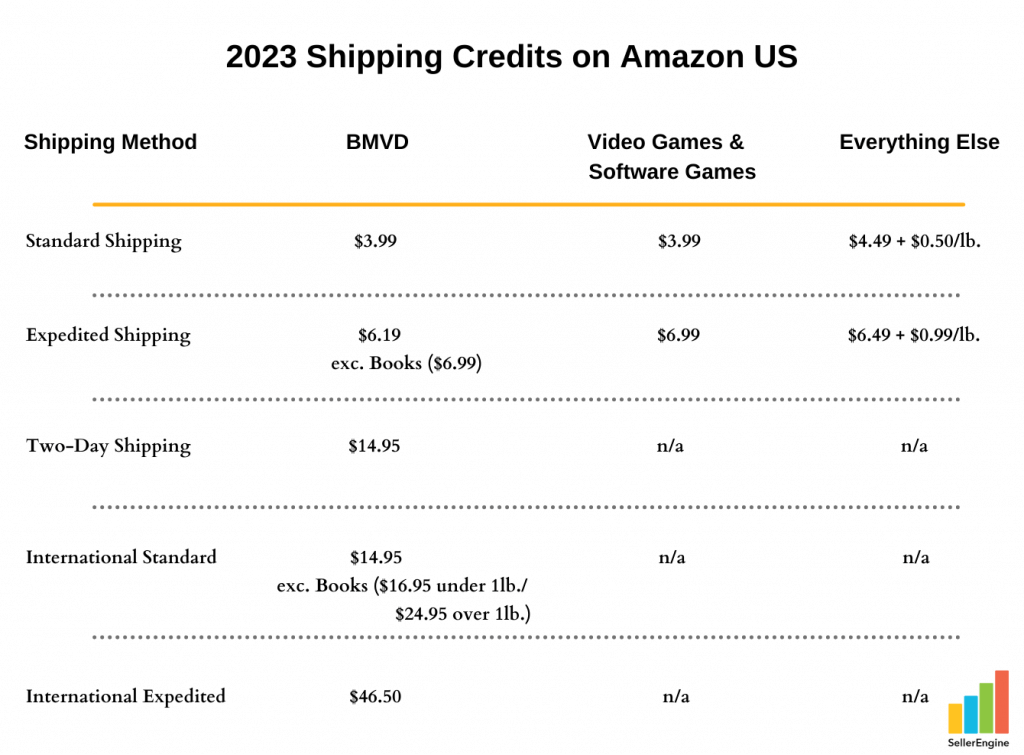

Sellers who fulfill their orders don’t pay Amazon fulfillment fees. But they must cover the cost out of what the buyer pays. Since shipping credits for individual sellers don’t usually cover the cost of shipping to buyers, sellers opt for the Professional plan and set their own delivery charges.

Sellers who outsource fulfillment to Amazon must pay FBA fulfillment fees to cover the cost of shipping, handling, and customer service. They vary depending on the type of product, weight, and size. They start at $3.22, but can run into triple digits for oversized dangerous goods.

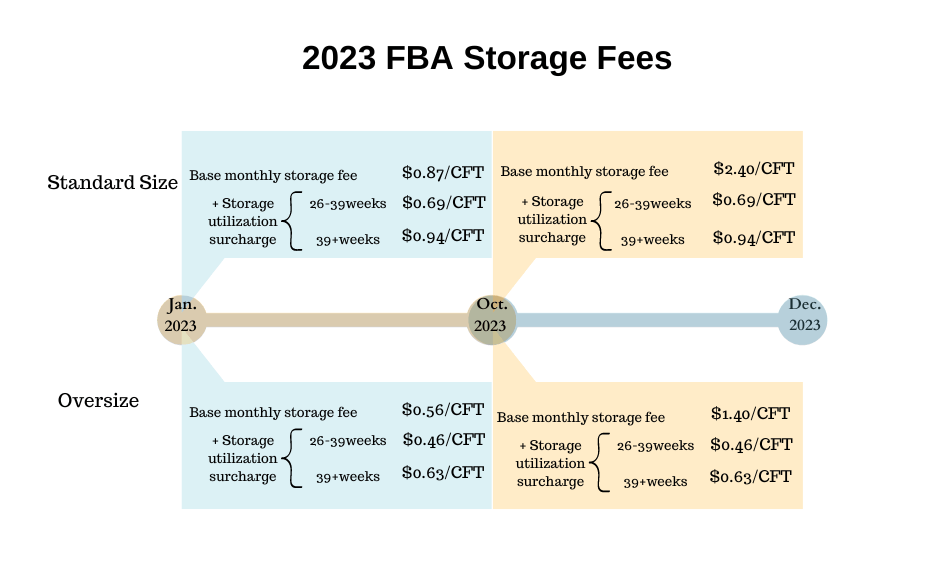

Aside from fulfillment, Amazon charges for storage depending on the time of year and the daily average volume of the items you send to fulfillment centers. You’ll likely pay monthly storage fees, storage utilization surcharge, aged inventory fees, and possibly even overage fees, if you go over your allowance.

Amazon Seller Taxes

Amazon estimates customs and sales tax for buyers during the checkout process. These Amazon taxes vary depending on the country, state and type of address an item is being shipped to (i.e., residential vs. commercial). US buyers pay sales tax on deliveries to 46 US states, as well as the District of Columbia.

Amazon may also apply a seller fee tax (e.g., on Amazon Mexico), value-added tax (Amazon Europe) or a variety of service, utility, or product-specific taxes. Some items may qualify for exemption. For instance, back-to-school items benefit from a Sales Tax Holiday on Amazon US before school starts.

As a seller, you are responsible for paying income taxes and any customs and duties on FBA shipments to fulfillment centers. As shown in our post, “Logistics and Customs”, some shipments call for MPF, HMF, HTS, and FET fees. This tutorial from The Scarborough Group has more on this topic.

Tips for Avoiding Unexpected Charges

As you can see, the cost of selling on Amazon isn’t so straightforward. Up-front costs like Amazon fees can amount to about a quarter of your earnings. Taxes and hidden costs eat away at your profits. Let’s not forget you’ll have hidden fees and add-on costs as well. Here’s how to prepare for the unexpected:

- Check what fees and taxes apply to every item you plan to list. If you can’t find this information on Amazon’s official help pages, contact Amazon customer service for help.

- Bear in mind that Amazon fees and taxes are not set in stone. You should check current rates regularly to make sure you’re not being stretched to the limit.

- To estimate your Amazon fees, use a reliable and secure fee calculator like the FBA Revenue Calculator.

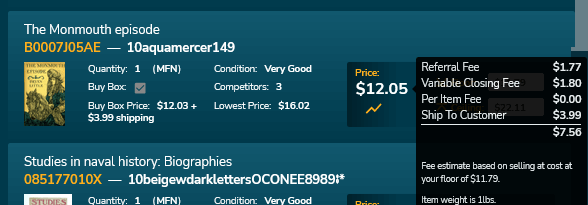

- If you’ve signed up for Sellery, simply scan an item or type in its ASIN to see what you’d pay in Amazon inventory costs, fees, and commissions. Whenever Amazon announces a fee change, Sellery updates these costs within hours.

- If you have an automated repricer like BuyBoxBuddy, whose algorithm automatically factors in every change to keep your prices lucrative, simply check your price calculation box. It displays up-to-date costs and shows you an accurate price calculation.

We hope this brief outline of Amazon taxes and fees has cleared things up for you. If you want your Amazon fees and taxes explained in greater detail, please browse our blog posts. Better yet, get in touch to find out how an automated repricer like Sellery or BuyBoxBuddy can work it all out for you, so you don’t have to.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.