It’s time to adopt a new paradigm: Brexit & Amazon. With mere weeks before the UK’s transition period comes to an end, MFN sellers are busy forging new pathways. To keep ahead of the curve, make sure you prepare your business for Brexit too. Here’s a handy Brexit prep checklist for Amazon sellers who trade across the border.

We’re eight weeks away from the historical moment when the UK leaves the EU Customs Union. The full impact of what ‘Brexit & Amazon’ for MFN sellers is starting to hit home. But how do you prepare your business for Brexit? Here’s some background Brexit prep

The Effects of Brexit on Trade

After holding a referendum in June 2016, triggering Article 50 of the Lisbon Treaty, and asking for three extensions to negotiate, the UK left the European Union on Jan. 31, 2020. On the last day of this year, when the transition period ends, the UK will also leave the EU Single Market and Customs Union.

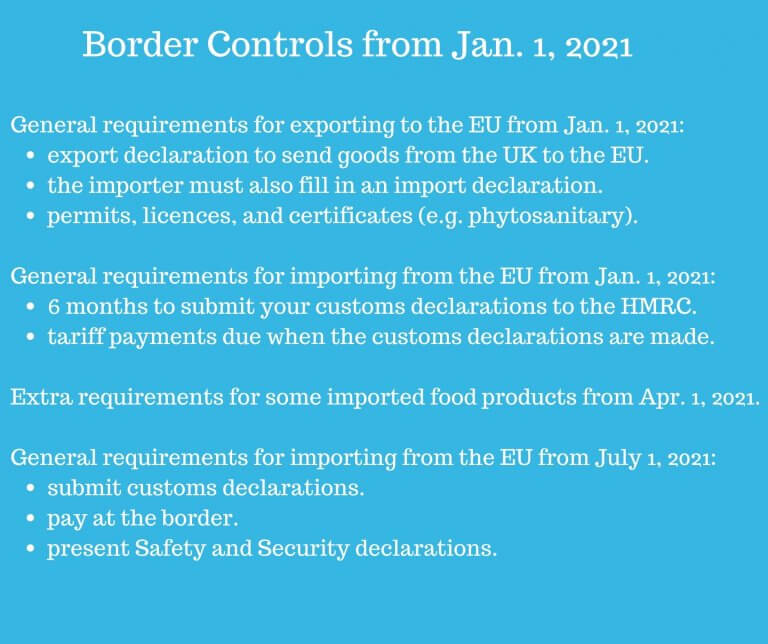

Things will change in 2021. Tony Thomas, a deputy director working for Her Majesty’s Government, lays out a general timeline for these changes in a recent webinar for Amazon sellers, as seen below. Note that the UK border will gradually bring in changes up until July 1, 2021, which is bound to cause confusion and delays.

UK Sellers: Prepare Your Amazon Business for Brexit

Amazon doesn’t have the means to check the products sellers ship across the border. So, it can’t move products on behalf of third-party sellers. When it comes to shipments to and from the UK, sellers are on their own.

So, from then on, when it comes to shipments to and from the UK, sellers are on their own. This Amazon seller handbook shows you how to prepare your business for Brexit. In a nutshell, MFN sellers in the UK must fulfill these requirements to clear customs next year:

Then there’s the fact that a customs border will be in force between the UK and the EU on the first day of the year. There may also be new border controls for the Port of Dover and the Eurotunnel. Trucks weighing over 7.5t will need a Kent Access Permit before they reach the Channel, as mentioned in Digest 9.

When it comes to shipping, UK sellers can continue to use the same couriers, if they comply with the new rules. However, they will be responsible for paying all duties and tariffs before delivery, if they send bulk items to Europe. But sellers can also opt for DAP – meaning that the customer will have the VAT and Customs border – if the packages are sent 1 by 1 packages from the UK to EU customers. Charlie Miligan of Regional Express warns sellers that the HMRC doesn’t have the capacity to deal with surges and delays.

To make matters worse, the UK’s freight handling service, CHIEF, currently handles 55 million declarations per year – roughly half of maximum capacity. The post-Brexit volume is likely to be 5 times higher. And the much-touted Customs Declaration Service (CDS), meant to replace CHIEF, is still not ready.

So, as a UK seller shipping to the EU, you should make sure that you take these basic steps to comply with customs law:

- Familiarize yourself with the commercial invoices your courier uses (printed in 3 copies, 2 for the pouches and, 1 for the driver) and the ‘pre-advice’ information you should fill in on these documents.

- Sign up for Royal Mail Shipping Solutions and make sure you know which of Royal Mail’s customs note you need to use (CN22 for goods costing you under £270 or CN23 for more expensive items).

What happens if you break customs law in the UK? According to Notice 301 of Sep. 23, 2020, making an inaccurate declaration attracts a penalty of at least £250. And regardless of who submits your declarations, the liability lies with you for a full three years after filing the declaration.

Brexit & Amazon MFN Sellers

According to the Brexit webinar for seller-fulfilled orders, not much will change in 2021, in terms of listing. Assuming customers in the EU will continue to buy on Amazon UK and vice-versa, sellers can carry on listing items for customers across the border.

The Build International Listings (BIL) tool stays the same. Assuming sellers have the right to sell their items internationally, they can continue to list on whichever venue they please. However, prices should reflect upcoming changes in costs, such as customs duties, tariffs, tax consultancy fees, broker fees, return costs, etc.

Brexit Checklist for All MFN Sellers

So, how can you make sure that you are ready for post-Brexit trading? The answer depends on the type of products you sell and where you sell them. Here are some of Amazon’s suggestions for MFN sellers who want to send and receive items across the EU border after Jan. 1, 2021:

- Register for VAT in every country you’ll store items in. Amazon will reimburse you the first year’s fees if you sign up for VAT Services on Amazon in up to 7 European countries. Ts&Cs apply. This handy VAT handbook explains your obligations in more detail.

- Make preparations so that you or your Tax Consultants can complete tax returns in every country you trade with so that you can claim back the VAT you paid at the border.

- Onboard with a customs broker to prepare your customs declarations (SAD), if necessary.

- Set up a duty deferment account if you import goods to the UK.

- Get your UK EORI number to ship bulk inventory in/out of the UK as the Exporter of Record (EoR), and your EU EORI number to ship in or out of EU countries.*

- Make sure the Importer of Record (IoR) also registered for an EORI number in their country.

- Check current trade agreements for preferential Rules of Origin (zero duty or lower duty rates) for the UK and the EU.

- Check trade tariffs (duty and VAT rates) and find your 8-digit Harmonised System (HS) Codes for your products in the UK and the EU.

- Currently, the Customs thresholds in the European Union are:

• Below €22 in value – No VAT or duty will be due

• Value is between €22 and €150 – VAT only will be applicable

• Above €150 in value – both VAT and duty will be applicable

- Get the intellectual property A collection of ideas, concepts, … More rights (IPR) owner’s consent to sell items across the border, along with any licenses and certifications needed abroad.

- Check that the listing information matches the commodity code, and is compliant and accurate.

- Go to Seller CentralAmazon Seller Central is a portal or a h… More and enable Multi-Country Inventory.

- Consider Returnless Refunds if you don’t have a local return address for EU buyers and you don’t want to bother with cross-border returns labels. Go to Returns Settings > Returnless refunds.

- Set up pre-paid return labels, be they domestic or international, in Settings > Return Settings. Bear in mind that you may need to cover the cost of return shipping, depending on the reason.

- If you don’t offer pre-paid return labels and want an EU buyer to return an item to you in the UK, you must arrange to collect the item yourself and pay customs duties in advance.

- Update transit time in shipping templates to reflect the fact that exports take longer to deliver. Go to Settings > Shipping Settings > Shipping Templates.

- Update handling time manually at Inventory > Manage Inventory > Edit > Offer > Handling Time.

- Update handling time in bulk by downloading an inventory file from Inventory > Add Products via Upload > Inventory Files > Inventory Loader, and then entering an “a” in the Add-Delete column and the number of days in the Handling-Time column.

- Reprice your items to include customs duty and tariffs. Amazon forbids sellers from charging buyers delivery duties.

- To stop selling in any EU country, disable listings using holiday settings. Go to Seller Central > Country toggle button > Settings > Listing Status > On Holiday.

*You may not need an EORI, but it’s best to err on the side of caution and request one. Getting a UK EORI is free and it only takes minutes.

For help setting up your EU EORI, ask your tax adviser or freight services provider.

Having rounded off this post with a 20-point Brexit prep checklist, it’s time to point out that Brexit & Amazon changes will also impact FBA sellers, brand owners, and other merchants. If you sell FBA items, be sure to follow our blog this week to find out how you can prepare your business for Brexit too.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.