Editor’s Note: Originally published on Dec. 22, 2020. Last updated on Nov. 30, 2022.

As a Marketplace Facilitator, Amazon has thrown a few legal curveballs in its day. But it’s also faced two major setbacks: marketplace Product liability and marketplace Sales Tax liability. Does this give third-party sellers carte blanche to bend the rules? Quite the opposite. It’s all eyes on them. Here’s how to make sure you don’t fall foul of the law in 2023.

Tax season is right around the corner. For third-party sellers, this is also a time of slow sales, high return rates, and mounting claims. So, today we’ll discuss a little thing called liability – something Amazon’s been blissfully unbothered with right up until the turn of the decade.

As a Marketplace Facilitator, Amazon is legally accountable for 2 major issues: marketplace Sales Tax liability and marketplace Product liability. But far from letting third-party sellers off the hook, Amazon’s new duties have come with extra challenges for merchants.

A. Marketplace Sales Tax Liability

What is a Marketplace Facilitator?

For tax purposes, Amazon.com is what’s known as a Marketplace Facilitator. According to the dedicated Amazon help page, that’s any online marketplace that sells goods and services on behalf of third-party sellers.

So, in the USA, where Marketplace Facilitator legislation applies, Amazon is bound to comply. The law states that Amazon has a duty to calculate and collect sales tax from sellers who go above a certain threshold, handing it over to whichever state the product or service is received in.

| Takeaway: in states that enforce this law, Amazon is responsible for collecting and remitting the Sales Tax to the state. So, marketplace Sales Tax liability lies with Amazon here, not the seller. |

1. Where Does Amazon Have Marketplace Sales Tax Liability?

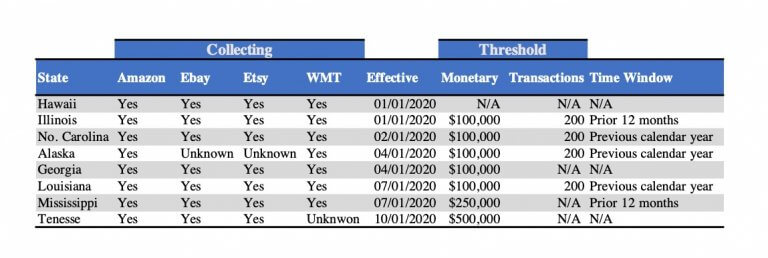

Most of the 47 participating states have enforced this law since 2019. Some introduced it in 2020, as seen in the table below. Kansas and Florida were the latest additions, back in 2021. The full list of liability thresholds is available to download on SalesTaxandMore.com and a 3rd party collection requirements list is due soon.

Note that the upcoming pdf file is titled: “Marketplace Facilitator Third-Party Collection Requirements”. If it’s anything like the last list, it won’t make any reference to State Tax Holidays. This is when states waive taxes on specific dates of the year and for certain types of products.

2. What Does the Marketplace Facilitator Law Mean for Sellers?

On the face of it, the law sounds like it might get you off the hook if you end up owing tax, but it doesn’t. If anything, it makes it more likely for sellers to be audited by the State, as A2X puts it. And sellers won’t get any extra protection just because they’ve been trading on Amazon.

Also, there’s the time factor. This law doesn’t protect you against any wrongdoing that might have occurred before it came into force in a particular state. So, any backdated Sales Tax is still due. Also, Amazon isn’t responsible for taxes incurred on other platforms.

3. How Can Sellers Make Sure They Comply?

It’s business as usual, right? Wrong. As TaxJar explains in great detail, every state has its own take on this law. Also, some marketplaces got on board earlier than others. So, third-party sellers trying to list on Amazon should get in touch with a tax consultant to check if they should:

- register for tax and file a sales tax return yearly, even if it’s a ‘zero tax’ return.

- submit returns for backdated tax (on sales that took place before the law was enforced).

- file in tax returns whether any sales were through a market facilitator or not.

- collect sales tax on the shipping fee too (which doesn’t apply to brick-and-mortar shops).

Unfortunately, there’s more to it than that. The whole point of the Marketplace Facilitator rule is to make online platforms hand over sales tax, so that third-party sellers don’t get away with not filing returns. This would cover some of the revenue lost from brick-and-mortar stores.

But some may find loopholes, causing states to ramp-up audit activity, as eCommerceBytes warns. So, for remote sellers who don’t fully understand nexus requirements (see So. Dakota v. Wayfair case) and local marketplace facilitator rules, there’s a risk that they may fall foul of the law.

Then there’s also the issue of product liability…

B. Marketplace Product Liability

As an online marketplace, Amazon is also liable for the safety of the products merchants list on its website. Up until 2018, it had an iron-clad defense when customers took it to court over product safety: it’s only the middle-man.

The Weintraub v. Daihatsu et. al. case is a fine example. So, best-case scenario: an insurance company covered some of the damage. But then came the Bolger v. Amazon (Aug. 2020) case, where an FBA laptop battery, shipped in an Amazon box, exploded within weeks.

The buyer lost the case, but won the appeal. Then, Amazon said in a blog post that it would accept liability for 3P item safety if all other marketplaces do. But the law that would have made that happen, AB 3262, was first watered down and then shelved.

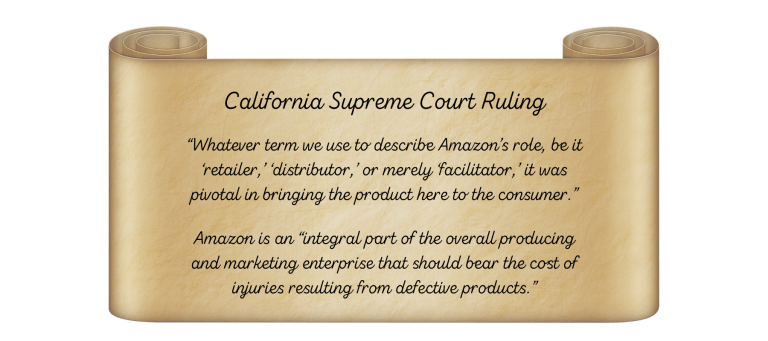

So, days later, Amazon filed a petition saying, among others, that the legislature should get to decide the limits of liability, not the courts. But in a landmark decision, the California Supreme Court (CSC) ruled that Amazon was liable for a particular defective product.

Amazon then asked for a review. It was denied, according to Bloomberg Law. So, the California Supreme Court ruling stands. It states that whatever Amazon calls itself – retailer, distributor, marketplace facilitator- is beside the point. Marketplace product liability rests with Amazon.

It should come as no surprise. Unlike Etsy, for instance, Amazon actively advertises and suggests some 3P products (Amazon’s Choice badge). So, it isn’t really just a middle-man. What does this mean for sellers? It can cause sudden waves of suspended listings like the 2021 toy purge.

But most importantly, it caused Amazon to change the BSA. It now asks 3rd party sellers to share responsibility for product liability claims and hold a certificate of insurance with a limit of $1million if they make more than $10,000/month over 3 consecutive months.

This is only fair. Brick-and-mortar stores are already liable for the safety of the products they sell on behalf of others. Here are some of the costly documents and processes a brick-and-mortar store would need to produce to stock items and stay in business:

- General liability insurance (for property damage and bodily injury from products, services, and operations).

- Product liability insurance (for compensation due for faulty items and QC slip-ups).

- Due Care documents (drafting and revising instructions and usage recommendations).

- Design consultations for products that need to be customized or altered.

- In-house testing for exclusive stock and product bundles.

- Import filings (physical stores are often the Importer of Record, but Amazon never is).

- Implementation of COVID safety, occupational safety, and health measures.

This is not to say that Amazon doesn’t incur costs for similar documents and procedures. But as long as buyers have no claim against a faulty 3PThird-party sellers are independent indi… More product sold on Amazon, then the benefits are not passed on to the buyer in the same way that they are with brick-and-mortar shops.

1. The Ramifications of the CSC Ruling

Amazon is extremely flexible and agile, so it’s unlikely that any ruling would seriously undermine its growth, even if it sets a precedent. But it may have wider ramifications. Here are some likely outcomes if courts use this ruling and a revamped version of AB 3262 comes into force:

- All or most Marketplace Facilitators are held liable, in terms of safety, for every product they list.

- Small Marketplace Facilitators have a difficult time adapting, unless they come up with other streams of revenue (e.g. advertisingAdvertising is a means of communication … More and sponsoring 3PThird-party sellers are independent indi… More products).

- Amazon abruptly changes its business model (FBA especially), raising fees and passing the liability expense on to third-party sellers.

2. Other Recent Rulings Affecting 3P Sellers

In 2020, a DMCA update downgraded Amazon from a legal holder of seller funds to a ‘constructive trustee’. This means Amazon isn’t allowed to place a permanent hold on funds for copyright issues.

That’s not all. Two new bills threw a spanner in the works that year. The first is the SHOP SAFE Act of 2020. It makes platforms partially liable if third-party sellers who can’t be tried in the USA use a counterfeit mark to list and sell, without sufficient verification from the platforms.

The second is the INFORM Consumers Act. It requires online marketplaces to check the identity of high-volume third-party sellers at least once a year. It also mandates that they disclose to customers certain verified information about them (e.g. contact information).

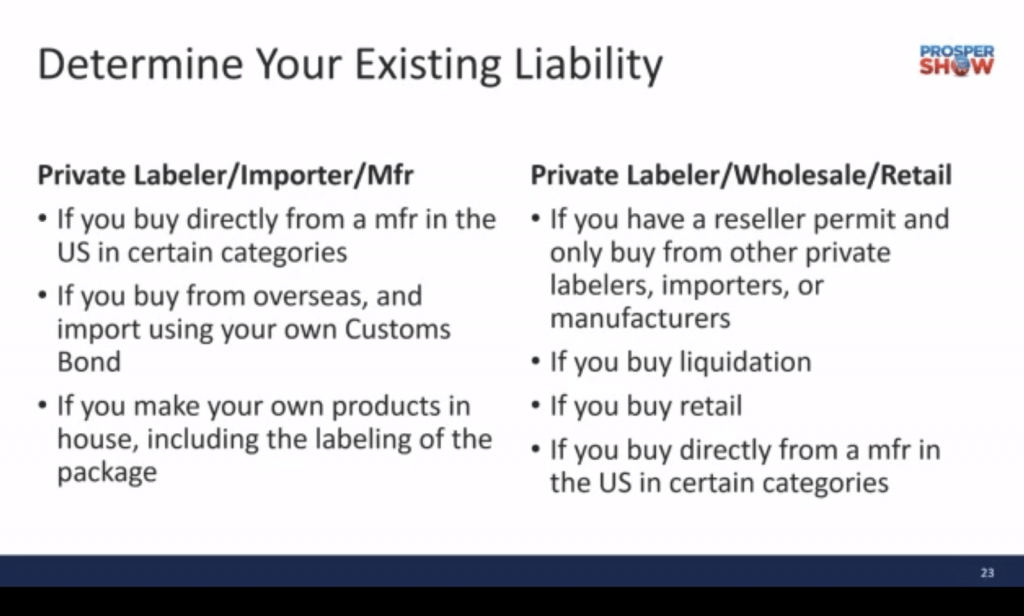

3. How to Determine Your Marketplace Product Liability

Whatever your business model, there is at least one way to check if you are responsible for the safety of the products you sell. This Prosper Virtual Conference presentation outlines the basics of assessing marketplace product liability:

4. How to Minimize Your Marketplace Product Liability

One school of thought says prevention is better than the cure. If you don’t have complete control over how your products are manufactured, tested, and shipped, it would probably be a good idea to have a backup 3PL, look for alternatives to FBA, and try these corporate housekeeping tips:

- Once you evaluate your risk (see above), budget for it.

- Source pre-certified products.

- Outsource product testing at production or testing level (the smaller the lab the better).

- Carry out in-house product inspections and submit the results before shipping.

- Conduct your own Factory Audits or review prior ones to see if your supplier manufactures to spec and complies with the standards.

- (NEW!) Secure “Social Compliance” verification.

- Find good providers of commercial and products liability insurance – don’t wait!

- Perform mock audits with qualified companies.

- Track all customer complaints.

- Practice good paperwork storage, backup your data, keep up with legal changes (e.g. the statute of limitations) and keep in touch with your accountant and your legal team.

To recap, Marketplace Facilitator is a concept that requires platforms like Amazon to collect marketplace Sales Tax on all sales over certain thresholds and remit them to certain states. This includes the sale of products listed by third-party sellers.

Marketplace Product Liability is a notion made possible by a ruling in the case of Bolger v. Amazon.com. It says that Marketplace Facilitators like Amazon are not absolved of product safety obligations just because they call themselves middle-men.

This brings us to the end of the article. And it also brings us one step closer to the year 2023. With massive changes afoot, we hope that sellers will heed our advice and start taking preventive steps before the festive season takes over.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.