This just in: the UK Finance Bill of 2018 is due to come into effect soon. All sellers with physical inventory in the UK must upload their UK VAT numbers in Seller CentralAmazon Seller Central is a portal or a h... More to comply with new requirements.

New Legal Requirements for Sellers with Stock in the UK

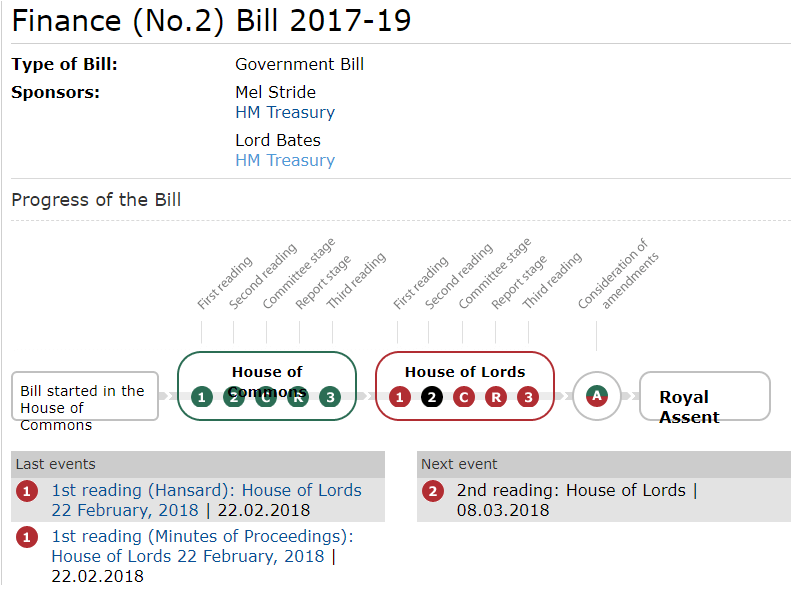

Published on December 1st, 2017, the Finance (No. 2) Bill 2017-19 is currently awaiting a second reading in the British Parliament’s House of Lords. The reading and a general debate are scheduled for Thursday, March 8th, 2018.

This bill makes various legal provisions in connection to finance, so it’s bound to affect foreign sellers operating in the UK. In fact, Amazon.co.uk will be required by law to block some sellers from listing altogether.

Who Does the New Finance Bill Apply To?

Sellers who are not based in the UK but who store their goods in the country or sell more than £70,000 worth of goods to UK-based customers will be blocked, unless they can prove that they have registered to pay UK VAT.

It’s not yet clear if, when, and for how long accounts, listings, and disbursements will be affected. To ensure that seller accounts run smoothly in the next few days, Amazon UK has already sent out a formal notice. But it’s easy to overlook these emails because they’re not very specific.

We encourage all of our readers selling on Amazon UK to check that they’ve entered their UK VAT numbers in Seller Central. Then please help us spread the word.

When Do the New Laws Come Into Effect?

We expect the bill to pass in the next few days, before the start of the new accounting year (April 1st). Its progress from the House of Commons to Royal Assent is available to view online here.

Fig. 1. Status of Finance (No. 2) Bill 2017-2019 as of March 5th, courtesy of www.parliament.uk

As shown, the bill will be given a second reading on March 8th. Then it’s due a committee review before the final reading and the necessary amendments are made. So, sellers who don’t currently comply with the new law have a few more days to sort out their tax affairs.

The inner workings of the British Parliament are complex, so we don’t have a definite date yet. Here’s a 60-second video presenting the bodies of Parliament and the processes involved in turning a bill into law in the UK:

How Can I Comply With New Amazon Requirements?

If you haven’t registered for VAT, and you’re not sure if you should, please read Amazon UK’s VAT Resources page. Amazon partnered with KPMG to help you figure out if you need to register, so go ahead and take the VAT registration test if you have any doubts.

If you need to register, take a look at the official page for VAT Services on Amazon. They register and file your VAT returns for you through Avalara in exchange for a yearly €400 fee. Here’s a short video explaining the benefits of signing up.

If you’d rather go solo, the official UK VAT Registration page has all the information you need to register online, by post, or through your accountant. There’s also a VAT helpline for non-UK callers set up by the UK government department that collects tax, HMRC – which stands for Her Majesty’s Revenue and Customs.

For more hands-on help, there are various reliable video walkthroughs* for UK VAT registration. But please bear in mind that the HMRC website has gone through various changes in recent years.

*Disclaimer: We are not affiliated, associated, authorized, endorsed by, or in any way officially connected with the sellers or services featured in the video material above, or any of their subsidiaries and affiliates. The walkthroughs and tutorials featured above are for reference purposes only. We recommend that our readers speak to their accountants before they consider registering for any of the services above.

Can I See the Law for Myself?

Once it goes into effect, the bill will be referred to as the ‘Finance Act 2018’. The current Finance Act is available to view at Legislation UK and on the official page of the UK Government. The 2018 version will be made available online by the same sources as soon as it takes effect.

We can’t stress this enough: it’s really important that you register and share your tax information with Amazon. If you’d like to check that your tax information is in order, please get in touch with our SellerEngine Services team. We’re always happy to help.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.