On Jan. 1, 2021, the UK and the EU went their separate ways. But within days, issues started to crop up for online retailers on both sides of the Channel. Join us as we look at the new Amazon seller VAT requirements for selling across the UK-EU border, to better understand the true cost of Brexit for Amazon merchants.

Keep calm and carry on? Not an option if you trade across the UK/EU border.

Now’s the time to learn about the real cost of Brexit for Amazon merchants who trade across the Channel, and what you can do to mitigate it.

And if you’re thinking about selling on Amazon for the first time this year, there’s no better way to get a handle on Brexit’s many challenges.

Today we’re sharing our tips on how to reckon with the latest Amazon seller VAT requirements due to Brexit.

How Will Brexit Affect Amazon Sellers?

To the EU, the UK is now a third country market.

So, based on the EU-UK Trade and Cooperation Agreement, the UK is free to change the way it collects VAT, tariffs, and other duties on goods from overseas (EU included). And it already has.

The UK’s new trade terms will affect all sellers, not just those from overseas.

Sellers who didn’t heed our advice to register for VAT, set up duty deferment, and onboard with a customs broker will be hit the hardest.

But for now, the immediate cost of Brexit will be measured in:

- VAT customs threshold changes.

- New tariffs based on the ‘rules of origin’ framework.

The Real Cost of Brexit to Amazon Sellers

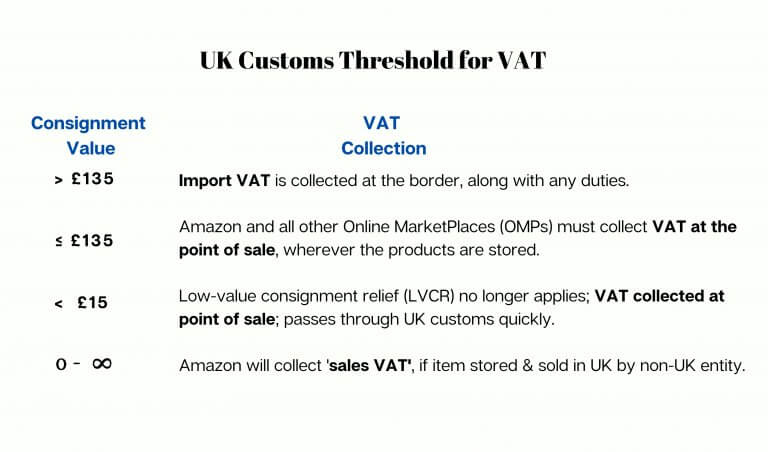

1. New Customs Threshold for VAT

In effect, the UK replicated existing EU customs rules for online purchases from non-EU countries. The requirements are the same, but the currency was changed from euro to pounds sterling and published on GOV.UK.

The EU will only start applying these customs thresholds to shipments from the UK starting in July.Until then, it applies the rules mentioned in our Brexit Guide for MFN Sellers.

But the UK got a head start, bringing them into effect on Jan. 1, 2021.

So, in the UK, Amazon and other OMPs are already applying it, as are border officers.

All products sold and shipped after 11 pm GMT on Dec. 31, 2020, are affected by this change, according to GOV.UK.

The complications? Some companies use the VAT flat rate scheme. Also, the UK is waiving supplementary customs declarations until July 2021 on non-controlled goods. So, importers who use delayed filing can put off declaring and paying duties and VAT until then.

But truck drivers have no way of knowing what and when an importer or a consignment booker declares or pays. For British truck drivers who have never been subjected to full (non-EU) customs checks before, delays due to incorrect paperwork come as a shock.

To make matters worse, there’s a virus travel ban across Europe due to the new strain of SARS-CoV-2 in the UK, dubbed VOC-202012/01. Unsurprisingly, logistics companies like DPD are avoiding cross-border travel altogether, especially after the Christmas lines in Kent.

7 Effects of These VAT Changes for Amazon UK Sellers

- Amazon UK now adds 20% to the price of items sold by non-UK sellers.

- Overseas sellers are finding it hard to compete with domestic sellers.

- Amazon hiked up prices by mistake to sellers who had already been collecting VAT.

- A reshuffle of search rankings has taken place due to these price variations.

- Amazon UK started charging EU buyers a hefty import fees deposit with a huge 60-day waiting period for refunds, as per Ts&Cs.

- Orders from the EU are dwindling as buyers are being dissuaded by other e-tailers from shopping in the UK due to delays and uncertainty.

- Sales ranks are likely to be affected soon, with sellers forced to undercut or dispose of valuable, once-popular FBA and MFN merchandise that can no longer be sold abroad.

3 Brexit Tips for Sellers

Make the Sales Tax Stand Out

If you’re a domestic seller shipping an item across the UK/EU border, use large print on your customs declaration and add a copy of the invoice in a clear envelope to the side of every box. That way, customs officials can quickly cross-reference the value and the sales tax levied.

This is especially important if the product is valued at under £15.

As Avalara explains, these items are only exempt from VAT if they are gifts.

If your customs declaration is smudged or unclear, the invoice would help customs officers check that Amazon already collected tax.

Why go the extra mile? Some sellers might fraudulently declare low-value items as gifts to save some money. Others might sidestep Amazon and get buyers to purchase again directly from them, VAT-free. Customs crackdowns aren’t unheard of, and why risk a delivery delay?

As for items valued at over £135, they always go through customs, so import VAT can be determined and levied at the border. Attaching an invoice to the outside of the box is a good way to minimize tampering during customs checks, especially if the item in question is a gift.

Keep the Price Under £135

If you’re a local seller, try to avoid charging extra or paying import VAT out of your own pocket.

Make sure you value your product or consignment at £135, max.

Break down the selling price of the item (up to £135), along with shipping, insurance, taxes and, other charges.

Think Units. Bear in mind that the VAT threshold is applied per consignment, not per unit.

So, if sending 2 items (or even 2 units of the same item) in the same box takes you above the £135 limit, consider sending your items in individual boxes, even if the buyer ordered them the same day. Ideally, you should offset the effects of this waste on the environment by switching to more eco-friendly packaging.

Also look at volume discounts. Depending on your per-unit price, it may be cheaper for you to sell fewer units at a time, and delivery could also be faster.

Think Bundles. Listing a bundle for up to £135 means you will be charged a 20% sales tax by Amazon, but the buyer won’t pay for import VAT or customs duties at the border.

Check customs duty rates (usually 2.5%) for these items to see if it’s worth slashing the price to save the buyer the stress of border controls.

Keep Up Cross-Border Trade

As UK luxury brands and supermarkets start to cut their ties with suppliers and customers in the EU and vice-versa, everyone expects domestic trade to thrive. As for international traders, everyone expects them to adapt to Brexit red tape.

People assume companies don’t ship across the border because they don’t want to bother with extra paperwork. But there’s much more to it than that.

Some suppliers don’t believe shrinking their cargo into smaller consignments to avoid paying hefty customs duties is worth the effort.

Others aren’t comfortable with the idea of having their products sold abroad at a higher price, disappointing or gentrifying their customer base. But whatever the reason, many companies are stepping aside and clearing the way for new business ventures.

Amazon sellers willing to reach out and join forces with friends across the UK/EU border can seize this opportunity to expand their customer base.

So, if you’re wondering how will Brexit affect Amazon sellers, we say the ball is in their court.

But in talking about new Amazon seller VAT requirements, we’ve only just begun to delve into the cost of Brexit for Amazon merchants.

Join us again next week as we discuss the thorny issue of tariffs.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.