Editor’s note: This is a guest post by Jennifer Dunn, Chief of Content at TaxJar

Owning a business requires tangibles like capital and a space from which to work, but to succeed in a long-term business, you also need to embrace intangibles like focus, dedication, and patience to deal with administrative hassles.

One of those administrative hassles is sales tax. It’s inevitable that as your business grows in sales volume and complexity, your sales tax reporting and filing grows more time-consuming and headache-inducing.

As a business owner, you must allocate your resources wisely. Read on to find out which of your resources sales tax uses, and to determine if it’s time to outsource sales tax and spend your time on bigger and better business activities!

Time

Above all else, dealing with sales tax – especially as your business grows – is time-consuming. As your business grows you’ll be required to file sales tax returns more often, handle higher volumes of transaction data when filing, and possibly even file sales tax returns to more states.

You have better things to do with your time. If you’re spending more time than you can spare on sales tax minutiae, it’s time to check out sales tax automation.

Patience

Are you a big picture person or a details person? Both types can be successful business owners, but only a details person will excel at the nitpicky aspects of sales tax. If you choose to handle sales tax manually, you’ll need to figure out how much sales tax you collected in every county, city and other special taxing district within a state. (This includes supremely tedious tasks like trying to figure out in which county a city lies.) If the thought of spending hours filling out little boxes with numbers doesn’t appeal to you, you may want to automate your sales tax life.

Organization

Each state gets to govern its own sales tax laws and rules, but that means that no two states are alike. As an online seller, you may be asked to file sales tax once per year in one state, once per quarter in another state, and once per month in yet another state.

On top of that, state sales tax due dates aren’t uniform. Most states require sales tax to be filed and paid by the 20th of the month after the taxable period. But other states set the deadline on the final day of the month, or the 15th or the 23rd or even some other date. Unless you’re highly organized, it’s all too easy to forget a sales tax deadline and end up paying a penalty and interest.

If your calendar isn’t as organized as you’d like it to be, you can at least strike remembering sales tax due dates off your to-do list by automating sales tax.

Focus

One of the more frustrating aspects of filing a sales tax return is the potential for human error. Just transposing one number can throw the entire filing off. Further, many states require that you round every number up and down. So, when you hit “submit” at the end of the filing and the systems throws out an error, was it a rounding error or did you transpose a number? Or was it something else entirely? If you’re not inclined to fight with an antiquated website to get your sales tax filed, it’s time to consider sales tax automation.

Willingness

You started your business to strike out and be your own boss, not to hassle with sales tax returns. Simply don’t want to file sales tax? We don’t blame you. Automate it and get back to doing what you do best – growing your business!

I hope this post has helped you determine whether it’s time to automate your sales tax life. If you have questions about sales tax, join over 7,000 other online sellers and tax professionals in our Sales Tax Community on Facebook.

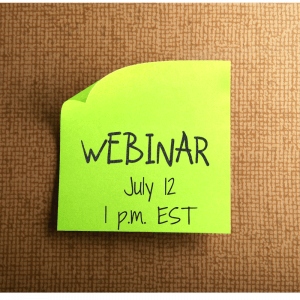

July is sales tax month! As such, we are organizing a Sales Tax 101 Webinar for Amazon FBA Sellers.

Find out more and register for the webinar below

[az_button_sh target=”_self” buttonsize=”button-small” buttonlabel=”Register for the Sales Tax Webinar” buttonlink=”https://sellerengine.com/taxjar-and-sellerengine-webinar/” class=””]

TaxJar is a service that makes sales tax reporting and filing simple for more than 8,000 online sellers. Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!