A year after it came into law, the INFORM Consumers Act is causing a stir again. How can US-based sellers ensure their compliance on Amazon? Find out what to do to protect your account while also supporting consumer protection on Amazon.

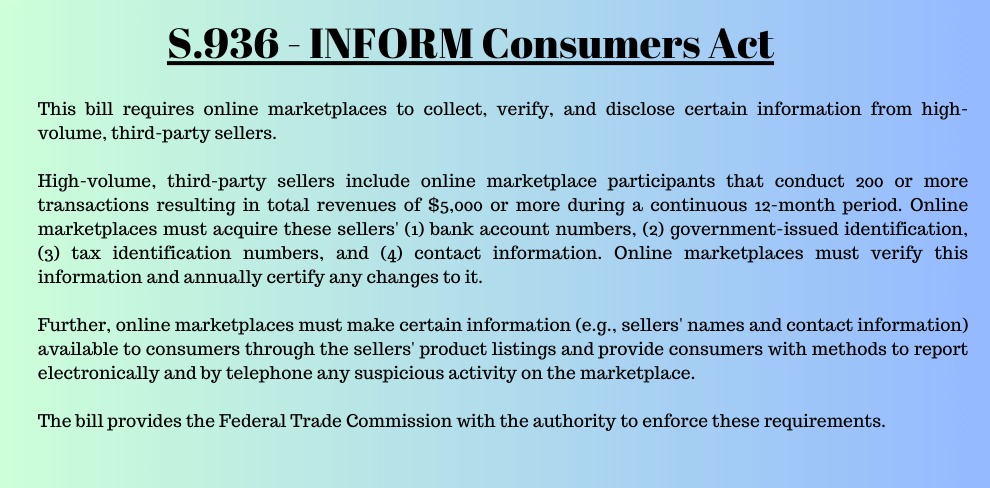

You may remember an earlier post on this blog titled “INFORM Consumers Act: How It Affects Amazon Sellers in the USA”. In it, we discussed S.936. It’s a bill that requires online retailers to be transparent about their identities. Also, it asks them to provide banking and fiscal data, and review it every year.

How Does INFORM Affect the Amazon Marketplace?

The law also requires platforms like Amazon to vet their sellers yearly. But, as explained on the official Amazon blog, vetting practices were already in place. In fact, Amazon claims its ML technology decreased bad actor attempts to open new accounts from 6 million to 800,000 in just 2 years!

Still, all high-volume sellers must go through this vetting system every year. By “high-volume”, Amazon means those who sell 200+ New/Unused items and make $5,000+ in gross revenue. But only if it’s over a continuous 12 months out of the last 24 months. Still, that’s most active sellers.

As the FTC explains, to ensure that it does not fall foul of the law, Amazon must meet 5 basic requirements. The INFORM Consumers Act compels the Amazon marketplace to:

- Collect contact, tax, and banking information from high-volume 3rd party sellers.

- Verify said information and prompt sellers to confirm its accuracy every year.

- Disclose information about sellers (and sub-seller) with over $20,000 in annual gross revenue in listings and order confirmations.

- Send written notice of non-compliance with a 10-day reply deadline and suspend sellers for withholding their information.

- Provide buyers with clear ways to communicate with sellers and report suspicious conduct (e.g., link or contact number on listing page).

Risks of Non-Compliance with the INFORM Bill

Violating the INFORM Consumers Act is treated as breaking an FTC rule. As such, not complying with the bill can cause Amazon to:

- Suspend sellers for withholding their information.

- Withhold seller funds indefinitely.

- Become liable for a civil penalty of $50,120 for every violation.

- Risk litigation with a State Attorney General.

\ Note: Compliance does not affect Buy BoxThis refers to the situation where a sel… More eligibility. But it does affect your ability to sell on Amazon. |

Problems with INFORM Vetting on Amazon

There were complaints of teething troubles on the Seller Forums and publications like Modern Retail as soon as the law came into effect. Here are some of the challenges sellers have faced with this new requirement for compliance on Amazon:

- Rise in suspensions. Some were due to data discrepancies, verification issues, and product authenticity concerns.

- Issues with the vetting process. Sellers grappled with new forms, faulty toggle buttons, and missing options in drop-down lists (e.g., countries like the USA and types of business entities).

- Inconsistent access. Sellers with Amazon Lending loans didn’t have access to some of the forms they needed to complete their verification.

- Extra paperwork. Aside from the usual documents needed for banking detail verification, sellers with credit union accounts needed extra letters that clearly showed the last digits of their account numbers.

- Strained communication channels. Sellers had trouble learning who to contact and how to appeal.

- General anxiety. This is said to have been caused by vague instructions and processing delays.

Information Amazon Sellers Must Provide Every Year

Sellers or the individuals authorized to act on their behalf must share their business data with Amazon and update it every year. Documents should be up to 50MB in size, valid, complete, displayed in full (front and back), in a supported format, and in high resolution. Amazon may ask for your:

- Seller name.

- Government-issued ID.

- Business address.

- Bank account information.

- Tax/taxpayer identification number.

- Working email address and phone number.

How to Update Your Business Information in 2024

Last month, Amazon wrote privately and publicly to remind sellers to review and certify the business data they have on file. So, as of April 2024, all sellers with at least 200 transactions or $500 in revenue in a consecutive 12-month period must review their data.

To update your data and avoid some of the issues above, you must access your Account HealthAccount Health is an Amazon page which c… More page, go to the Priority Actions section, and click “Review your account information”. Once that’s done, you can proceed to the Notice and Certification page, where you must complete the certification within 10 days.

During the process, a green check mark will confirm that your data is verified. A circle beside a URL shows that your data has either not been received or processed. Click the link to check. Finally, a circle with text grayed out indicates that no further action is needed, but may be later. So, check back soon.

Additional Seller Vetting Measures

Aside from the usual interactions via email or Seller CentralAmazon Seller Central is a portal or a h… More, sellers may go through extra checks. As EF explains, Amazon may also try to take some of these steps to verify your identity and confirm the validity of your documents:

- Telephone. Amazon will call you, the seller, on the phone number they have on record.

- Text. Amazon may send SMS text messages on the mobile number on record.

- Mail. Postcards may be sent to the address on record with unique verification codes.

- In-person interviews. IPIs are carried out through video chat.

Tips on Complying With INFORM on Amazon

It’s all been said before, but it bears repeating. Amazon can’t share your personal name or residential address. So, privacy isn’t an issue. The best thing to do is to try to comply with the law and prevent unnecessary delays and suspensions. Here’s how to handle your INFORM requests:

- Update your Account Information in Seller CentralAmazon Seller Central is a portal or a h… More as soon as there’s a change.

- Filter your Amazon emails and flag up INFORM requests.

- Designate verifications to a trusted employee or legal representative.

- If you use virtual addresses or personal bank accounts, change them.

- For identities used without permission or fraudulently, seek help from a seller attorney.

- Time your ID renewals well in advance of the annual confirmation deadline.

- Even if you don’t yet meet the criteria, be ready for impending verifications.

- Check that your INFORM requests are genuine and they link to your Seller Central dashboard.

- Before you enter your banking information, check that it’s the legitimate Seller Central page.

- Watch out for email spoofing and report suspicious emails to Amazon.

Contact Seller Support with questions about vague, irrelevant, or duplicate requests.

The INFORM Consumers Act is yet another challenge US sellers must face. But the bill serves as a catalyst for positive change in terms of consumer trust, so there’s every reason for Amazon and sellers to work together on this.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.

2 Responses

The information about US Amazon sellers needing to update contact, tax, and banking info annually under the INFORM Consumers Act to avoid suspension and fines was very informative. Thank you for sharing!

We’re glad to hear you’re finding value in our blog!