With prolonged uncertainty around a possible Brexit UK-EU trade deal, FBA sellers have even more reason to start their Brexit prep plan. If Brexit & Amazon keep you up at night too, there are a few steps you can take to make the transition to 2021 a bit smoother. Here’s how to prepare your business for Brexit.

In part one of our series titled “How to Prepare Your Business for Brexit”, we discussed some of the challenges MFN sellers might face as the UK’s transition period ends, and how to overcome them. Today we turn our attention to FBA sellers and see what the Seller Brexit Guide and Amazon Webinars have to say, among others.

For FBA sellers, the ‘Brexit & Amazon’ dyad might not sound as intimidating as what MFN sellers are faced with. But there’s still no UK-EU trade deal in sight. And we’ve been putting up with ‘uncertainty’ for over 4 years. All the more reason for FBA sellers to put their Brexit prep plan into action immediately.

How to Prepare Your Amazon Business for Brexit

For Amazon, not much will change after Brexit. It’s PAN-EU and EFN networks will go on as usual in continental Europe.

Amazon’s trucks will continue to ship “Sold by Amazon” items and FBA Export products to customers across the UK/EU border.

But FBA sellers will be affected.

As mentioned above, Amazon is free to send its own products, as well as FBA Export items.

But it doesn’t have the means to ship FBA products stored locally to buyers from across the UK/EU border on behalf of sellers after Jan. 1, 2021.

So, FBA sellers must take care of themselves.

Brexit and FBA Sellers’ Inventory

Within days, sellers’ FBA listings for EU products will no longer be active on Amazon UK and vice-versa.

But unsold inventory will continue to add up in storage fees.

So, Amazon has set some deadlines for FBA sellers who don’t want to have their inventory stuck abroad at their own expense.

Dec. 28 marks the last day that customers in the EU can buy products stored in a UK FC, and vice-versa.

But as James Wilson, suggests in his Get Ready for Brexit webinar, sellers should prepare well in advance. Any shipments for early 2021 should arrive either side of the border by Dec. 18 to avoid border delays.

Any remaining inventory will become stranded.

It’s unclear what will happen to it in the long run if it’s unclaimed, but it’s bound to attract storage fees for some time.

In a nutshell, sellers who don’t want to have products stuck in a fulfillment center on the other side of the border must do one of three things:

- shift it across the border by Nov. 14.

- sell out by Dec. 28.

- use a local address to remove it.

Post-Brexit Shipping Options for FBA Sellers

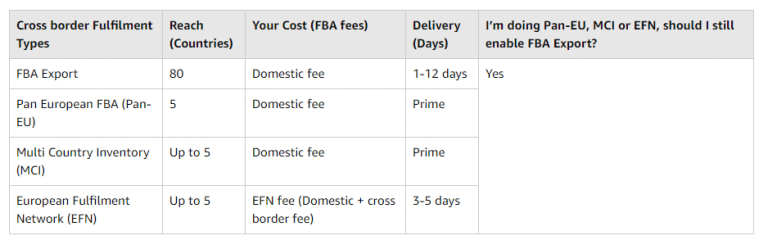

From Jan. 01, 2021, FBA sellers must maintain inventory in a UK FC for domestic orders. But they’ll also have a variety of options when it comes to selling in continental Europe through Amazon, as seen below. However, none of them apply to FBA Small and Light products. This type of inventory is strictly UK only.

Here’s what you can do to ensure that you have a steady stream of sales at the start of 2021:

- Ship inventory to an FC in one EU country only, and enable EFN. If the locals buy it, you pay local FBA fulfillment fees. If EU customers from abroad buy it, you pay EFN fees, which are higher.

- Send inventory through PAN-EU in bulk to one FC in the EU, and let Amazon decide which FCs to send onwards. You’re charged domestic fulfillment fees only.

- Opt into the FBA Export Program and enable “FBA Export for EU”. Your products will be shipped individually from the UK to customers in all 27 EU countries. You pay domestic fees and you don’t cover buyer returns.

Consider PAN-EU After Brexit

PAN-EU may be the most rewarding option because it enables you to access Amazon’s EU markets without worrying about slow deliveries, EFN fees, and customs requirements. But for this to work, you’d normally need 7 VAT numbers, one for each EU country where there are FCs:

- Germany

- France

- Italy

- Spain

- The Netherlands

- Poland

- The Czech Republic

Well, not anymore! The new PAN-EU VAT Aware Placement Service is available to sellers who want Amazon to distribute the inventory on their behalf, but don’t want to declare, pay, and recover VAT from all 7 countries above.

Here are the basic requirements for FBA sellers interested in this service:

- Enable sales in at least 2 countries via MCI.

- Obtain and upload VAT numbers for these enabled countries.

- Store inventory in FCs within those countries.

- List the items on 5 specific Amazon venues (DE, ES, FR, IT, and UK).

Enable Multi-Country Inventory

To allow your inventory to be transferred across borders, you must go to Seller CentralAmazon Seller Central is a portal or a h… More and enable Multi-Country Inventory.

In the Cross-Border Fulfillment Settings section, select Edit to expand the list of countries available to you, as seen in the image below, courtesy of Amazon’s Brexit Seller Guide.

If you don’t enable MCI by Jan. 1, Amazon will assign a domestic UK FC to your shipments.

You can then add extra “marketplace destinations” in your shipment workflow. On the Send/Replenish Inventory page, select the countries from the drop-down list.

Enable FBA Export

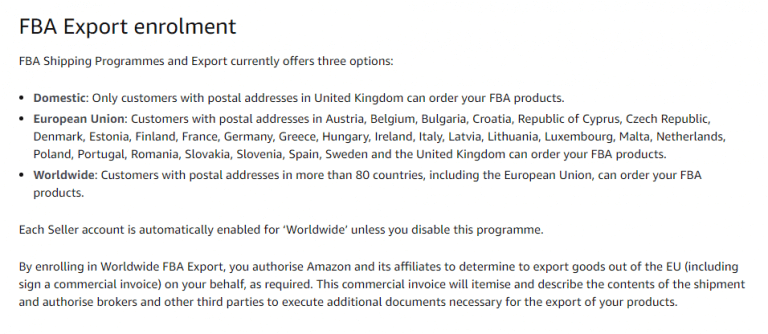

Third-party sellers in the UK can continue to sell products to customers in the EU using the FBA Export Program. But shipping times, VAT rates, and return rates may be different.

To check that you are enrolled, go to Seller CentralAmazon Seller Central is a portal or a h… More > Settings > FBA > Shipping Programmes & Export Settings > FBA Export for EU.

Note that not all products are included in the program. FBA Small and Light items, for instance, can’t be exported. To check eligible and enabled inventory, go to Reports > Fulfillment > Inventory > Show more > Exportable Inventory.

Remove FBA Inventory

From Nov. 14, any removals will only be processed if the return address is local to the fulfillment center.

This also applies to accounts where auto-removals have been enabled.

To remove individual items, simply create a removal order from the Manage Inventory tab in Seller CentralAmazon Seller Central is a portal or a h… More.

To arrange inventory returns in bulk, go to Reports > FBA, and download your Daily inventory report. Then access the Create Removal Order page as above, and download the flat file in the top right corner.

Fill in the table in the flat file with your daily inventory data.

Then, in the field titled “RemoveFromCountryCode”, enter the 2-letter code (e.g. DE, FR) of the country you want your units removed from. Then upload it back to the Create Removal Order page.

Split Your FBA Inventory

After Brexit, your SKUs and FNSKUs will stay the same, even if they were issued for items stored in a different country. But Amazon will calculate separate stock pools, health metrics, and restocking recommendations for UK versus EU inventory.

The Restock Inventory tool (Inventory tab > Inventory Planning) isn’t yet able to reflect the split. For now, it shows the total number of units Amazon thinks should be replenished for UK + EU fulfillment centers. But that’s where the Brexit Dual Inbound help page comes in. It shows a percentage split per ASIN.

| Note: The Brexit Dual Inbound report will only provide inventory split recommendations for products with a sales record in both the UK and the EU. Otherwise, the report will indicate 100% allocation in either one. The list is not exhaustive and you may have other ASINs that are eligible for inbounding to FBA.|

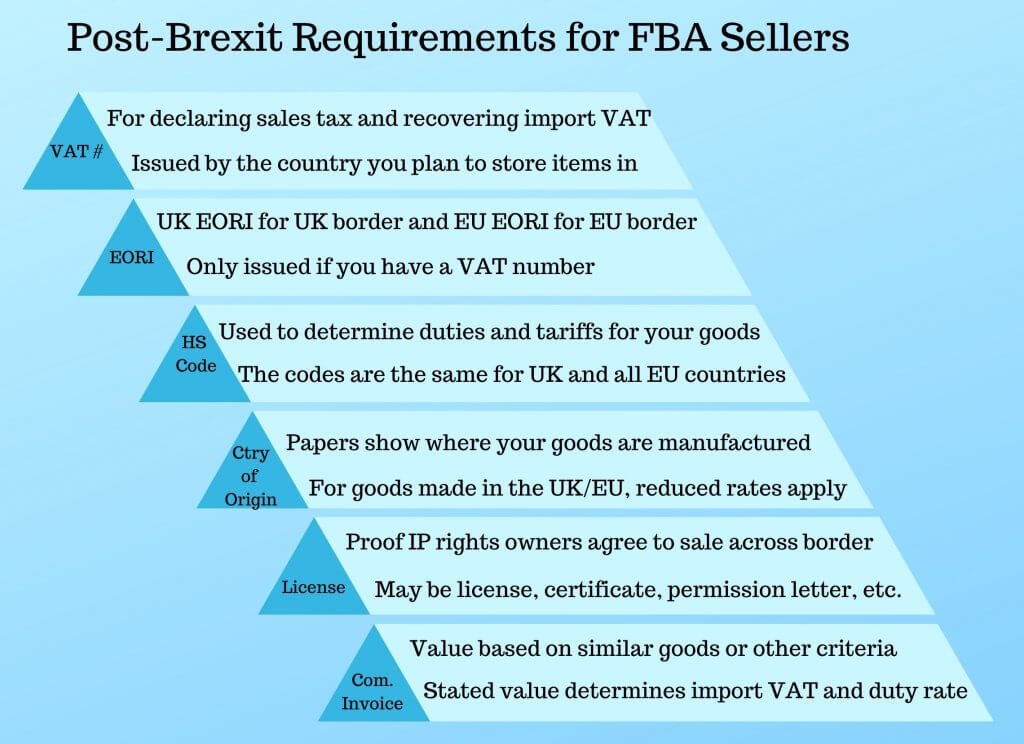

Post-Brexit Border Control Requirements for FBA Sellers

There are 6 steps FBA sellers must fulfill before they ship to a fulfillment center across the border. Failing any one of these can result in a penalty of at least £250 for submitting an inaccurate declaration at the UK border, based on Notice 301 of Sep. 23, 2020.

It’s worth pointing out that these requirements apply to both FBA and MFN sellers.

We have already mentioned them in Part 1 of the How to Prepare Your Business for Brexit Guide and offered links to all the relevant authorities in our Brexit prep checklist.

Here are a few more things you should consider, as an FBA seller:

- Applying for VAT is the first, most important, and most time-consuming step toward compliance.

- PAN-EU placement is available to you even if you only register for 1 EU VAT number.

- You need 1 UK EORI number for the UK border and only 1 EU EORI number for any EU border.

- Customs brokers tend to charge a customs clearance fee of £130-£180 per shipment, per transfer across the border. Some charge a percentage of the total value of your goods.

- Brokers may also charge an initial setup fee, as well as a deposit to cover unpaid duties.

- Amazon SPN features a variety of customs brokers, agents, freight forwarders, and carriers.

- Amazon VAT Services are free for the first year, and about €400 per country per year from then on.

- A UK/EU trade agreement might lower tariffs for goods manufactured in the UK/EU, but imports from third parties (e.g. China) don’t stand to benefit.

- Shipping some inventory from your manufacturer straight to the UK and some to the EU is ideal for items that don’t require prep, because you only pay customs duties once for each shipment.

- UK brand owners must register their trademark both in the UK and in the EU before they sign up for Brand RegistryAmazon Brand Registry is a tool that ena… More from 2021.

- Brand owners who list on Amazon UK can only continue to report potential infringements on Amazon.co.uk from 2021 if they enrol in Brand Registry with a UK IPO trademark.

- The UK’s Border Operations Model sets out the changes that will take effect on Jan. 01, 2021.

- You can look up HS codes, customs duty, and import VAT rates for your products on the UK’s official Trade Tariff page.

- There are 6 ways to ascertain the customs value of your products. Since FBA items have yet to be sold, Notice 252 indicates that FBA sellers should start with Method 2 to determine their value.

Now that we discussed Brexit & Amazon in greater detail, it’s time for us to let you prepare your business for Brexit.

Clearly, you’ve got your work cut out for you. But remember to check back with us every now and then. After all, what’s the use of putting together a brilliant Brexit prep plan, if you’re not up to speed with the latest developments in the world of Amazon?

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.