Still wondering how Brexit will affect Amazon sellers? Today we’re looking at some of the new tariffs for Amazon sellers trading across the UK-EU border. Join us as we reveal the true cost of Brexit for Amazon merchants.

In Part 1 of the series, we addressed VAT requirements.

We also touched on VAT customs changes as part of an analysis of the cost of Brexit for Amazon merchants.

But tariffs are also an important issue for those wondering how Brexit will affect Amazon sellers.

The Real Cost of Brexit to Amazon Sellers

2. Brexit Tariffs Explained

2.1 The Benefits of the EU/UK Trade Deal

When the EU-UK Trade and Cooperation Agreement (TCA) was signed, European retailers breathed a sigh of relief. And the news was especially good for import/export merchants.

That’s because the average EU tariff rate is around 1.5%, according to the Brexit Factsheet.

Merchants realized that, if not for this deal, they would have had to pay duty rates of up to nearly 150% on agricultural products, as the IFS explains.

For non-agricultural goods, the rates range from 0% to about 25%, according to the UK’s tariff profile.

But as the dust settles, it’s becoming clear that the trade deal only benefits a small section of the retail industry.

The rest are in for a rude awakening.

Why so? It comes down to prohibitive tariffs for Amazon sellers and all those who source materials from outside the EU & UK.

2.2 TCA: Trade Deal, Not Blank Check

As we mentioned in our Brexit Blues post in 2016, ‘free circulation’ only applies to products deemed to be made in the UK or the EU.

So, if any components or raw materials are sourced from elsewhere (e.g. China), the product may not benefit from the trade deal.

Eligibility for preferential treatment is based on the ‘rules of origin’ framework set out in the GATT, which was later superseded by the WTO. Customs officers apply them using the Harmonized System (HS) developed by the WCO.

So, these rules determine which of the goods that travel across the EU/UK border can do so using preferential TCA tariffs. And they also determine which ones can’t.

For this category, customs officers apply the WTO tariff schedule.

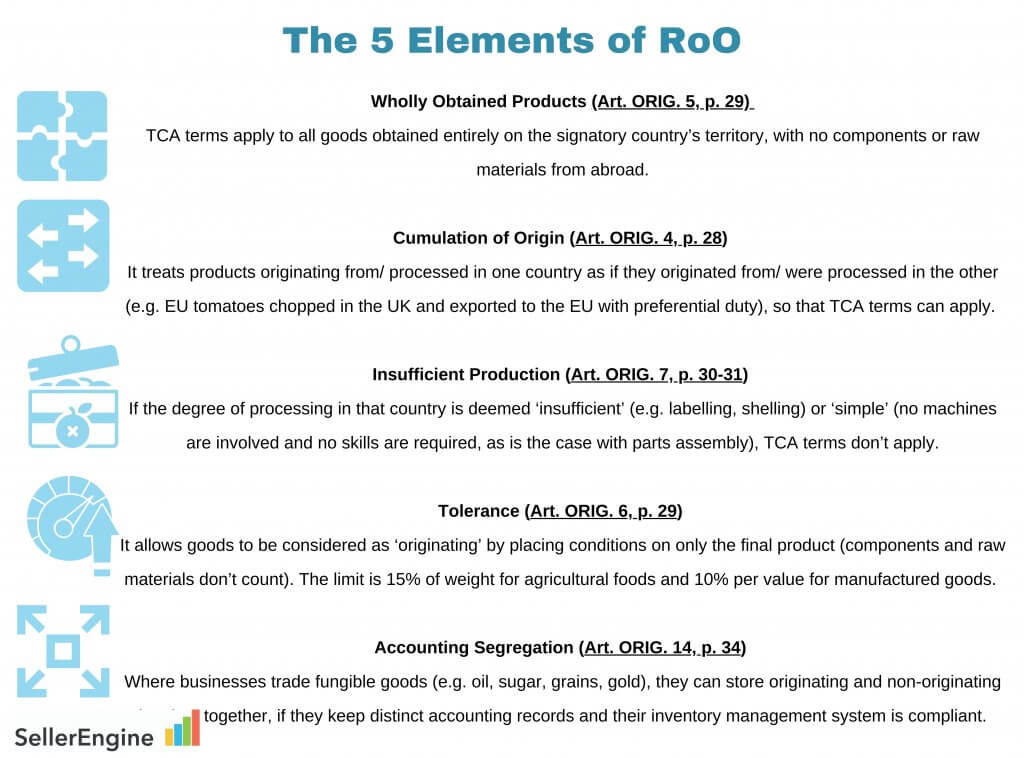

These five elements will inform the rules that apply to your specific product.

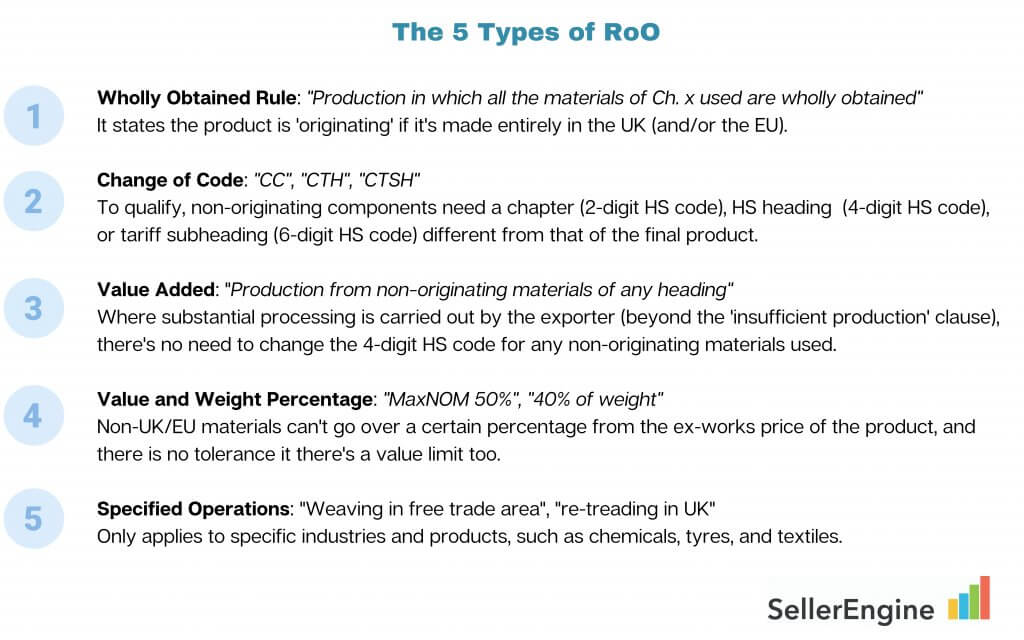

When you look up Product Specific Rules in ANNEX ORIG-2, p. 423 of the TCA, you’ll find phrases like ‘MaxNOM 50%’ or ‘CTH’.

These are abbreviations for the rules that apply in your case.

2.4 Rule of Origin Categories

GOV UK shows some of these codes and what they stand for.

Based on those examples, you could say that Product Specific Rules come in five flavors.

In the table below you’ll see the rules, codes, and conditions an exporter needs to comply with under the TCA.

To check that your products meet RoO requirements, please use the official Guidance and Resources pages on the GOV UK website.

Also, it’s best to double-check that you’re using the right HS code with the Trade Tariff Look-Up tool.

2.5 Key Takeaways:

Products created or processed in the EU from non-originating materials are deemed ‘originating’ in the UK and enjoy preferential treatment. This is due to bilateral cumulation.

The reverse is also true. So, if a product is made or processed in the UK, it’s given ‘originating’ status in the EU.

Once a product has ‘originating’ status, it’s considered to be 100% originating, whatever the weight or value of its non-originating components.

An ‘originating’ product’s non-originating components don’t count further down the line.

So, paradoxically, it can bring the final product’s total non-originating percentage down.

Packaging materials have no bearing on how a product’s origin is determined.

2.6 Claiming Preferential Tariffs

When trading across the EU/UK border, importers can claim preferential treatment right away under the TCA or within 3 years from import.

- To claim they must show the exporter’s proof of origin, which consists of these 3 declarations:

- Customs declaration

- Origin declaration (Statement on origin)

Supplier’s declaration

| Note: The importer’s claim and the exporter’s declarations and supporting documents must be stored for 4 years from the date of import and issue, respectively. |

In the UK, customs declarations can be filled in using the CHIEF platform.

But this freight handling system is being phased out.

Exporters are slowly switching to Customs Declaration Service (CDS).Note that UK traders have until June 30, 2021, to make them.

As for the origin declaration (aka invoice declaration), it can be made on a packing slip, invoice, or delivery note. But it must include the exporter’s EORI number (aka ERN for UK traders) and REX number (if sending consignments of over €6,000 to the EU).

The Statement on Origin text (taken from TCA ANNEX ORIG-4 p.482) is a brief declaration. But it’s legally binding. And it’s not valid indefinitely.

On the UK side of the border, a statement of origin is valid for 2 years.

On the EU side, it’s valid for 12 months only.

Also, not all consignments require a statement on the origin.

The EU is waiving this requirement for goods worth under €500, as long as they are not commercial imports.

And the UK will waive it for any goods worth under £1,000, be they commercial imports or not.

| Note: If a consignment is discovered to be part of a larger shipment, which was split up to avoid making the statement and paying duty, the waiver will no longer apply. |

Suppliers’ declarations are also needed from traders who source their products or materials. But only if the tariff heading (4-digit HS code) is the same for the material and final product. Or if the value of the material is over the limit, or there’s minimal processing involved.

| Note: Exporters don’t need supplier declarations until Dec. 31, 2021, but they may be asked to show them retrospectively. |

There you have it; Brexit tariffs explained in plain English.

If you’d like to know more about the effect of these new tariffs on for Amazon sellers, please join us next week for a brief run-through of how Brexit will affect Amazon sellers, in terms of tariffs, VAT, and other costs.

In our Brexit analysis, we’ll be discussing the wider cost of Brexit for Amazon merchants, and looking at the profitability of specific categories on Amazon.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments and keeps Amazon sellers up to speed.