Q4 is just around the corner. Merchants who list and sell on Amazon are already preparing for Halloween, Black Friday, and Cyber Monday. To make the most of your bottom line as you list and sell on Amazon in Q4, catch up on this month’s news.

New Amazon Fulfillment Centers

Amazon will be opening three new fulfillment centers in October. Sellers receiving EDI 850 are asked to update their systems to include these new locations, and to check that the SAN/FC codes are correct. Also, sellers must check that the invoicing system does not bill for sales tax, because tax lines will cause invoices to be rejected.

Amazon.com.kydc LLC, 2101 Danieldale Rd, Lancaster, TX 75134-1551

Amazon FC Code: PTX1, SAN: 99022198

***

Amazon.com.dedc LLC, 201 Emerald Dr, Joliet, IL 60433-3281

Amazon FC Code: MDW4, SAN: 7802463

***

Amazon.com.dedc LLC, 10240 Old Dowd Rd, Charlotte, NC 28214-8082

Amazon FC Code: CLT2, SAN: 990218X

***

Approval Needed to List Apple Products

Amazon UK recently announced that listing and selling Apple products requires approval. As of September 1, 2016, sellers who did not obtain approval to sell them will have their listings removed. The change will have no effect on sellers’ performance metrics.

For FBA products, merchants should either obtain approval to continue selling them, or create a Removal Order to by December 22 return or dispose of them. Amazon will reimburse removal fees for Removal Orders placed by October 25, 2016.

To ask for approval:

- Go to Seller Central>Inventory>Add a Product;

- Search for the ASIN and click the ‘Listing limitations apply’ link in the search results;

- Click Request Approval;

- Submit three invoices for at least 30 units in total, dating from the past 90 days.

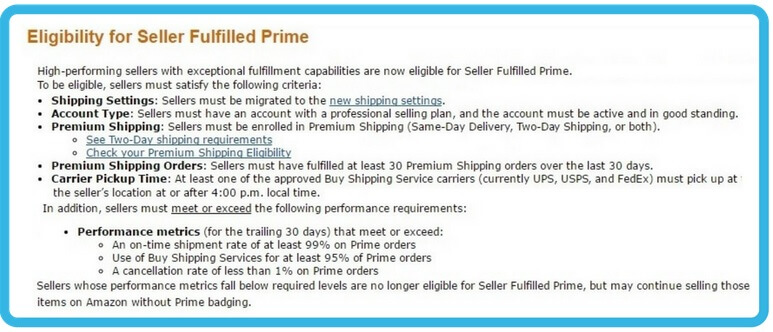

Seller Fulfilled Prime Now Taking Applications

Sellers can now ship directly to Prime customers. Launched in May 2015, this was once an invitation-only program. All those who meet certain requirements can now enroll in the Seller Fulfilled Prime program and access a trial period. Before you do, please read our blog post outlining the main advantages and drawbacks of Prime Badging.

Tracking Envelope and Flat Shipments Now Required

Providing tracking for at least 95% of items sold is the minimum threshold for the Valid Tracking Rate performance metric. So, it’s a mandatory conditionProducts can only be listed on Amazon if... More for selling non-FBA items on Amazon.com.

Starting October 12, 2016, small and light items priced over $10 USD (shipping included) must be tracked. Those under $10 in price can still be shipped via untracked USPS Standard and First Class Mail services.

Another option is to ship the items in parcels rather than envelopes, as long as the packaging is over 3/4” thick.. This would add $1 to $2 to your shipping cost, but you’d receive complimentary tracking.

Free Removals for FBA Sellers with Inventory in Europe

According to MWPVL International, Amazon’s European distribution network comprises nearly 50 Prime Now hubs, delivery stations, sortation centers and facilities (excluding the UK). With the PAN-European FBA service, sellers can fulfill and deliver orders to European customers by storing their inventory in Amazon’s fulfillment centers.

Amazon recently announced that sellers with inventory in any one of Amazon’s fulfillment centers in Spain, Germany, Czech Republic, or Poland will have their return and disposal fees reimbursed. All removal orders submitted between July 15 and September 30 2016 qualify. What’s more, Amazon will reimburse Long-Term Storage Fees paid in August 2016.

Inventory Template Upgrade

The Add Products via Upload page now features the option to update your inventory templates. The updated version was built to improve customer experience and help sellers catch errors. To update your inventory templates, upload your inventory template and check the Monitor Upload Status page. The click the “Download your submission in the updated template version” link.

Preview FBA Manual Processing Fees in Seller CentralAmazon Seller Central is a portal or a h... More

Sending shipments to Amazon without box content information? Starting November 1, 2016, you’ll be able to preview your FBA Manual Processing Fee while preparing the shipment. As you create your shipment, look for the Skip box information and apply manual processing fee option available in the Prepare Shipment step.

Note: The FBA Manual Processing Fee is $0.10 per unit (Jan-Oct) or $0.15 (Nov-Dec), and it’s charged 14 days after the shipment is received. FBA Small and Light items don’t need to have box content information, so they’re exempt from FBA Manual Processing Fees.

New Zealand GST Collection on Remote Services

Starting October 1, 2016, New Zealand residents who provide remote services will pay Goods and Services Tax (GST) on some services. Amazon is due to collect 15% GST on Selling on Amazon fees from sellers who are residents of New Zealand. Sellers who provide their GST registration number by September 30, 2016 are exempt.

To provide your New Zealand GST registration number to Amazon, log into Seller Central, choose Account Info under Settings, and click on VAT Information in the Tax Information.

DPD Label Cancel Launch

As of August 23, 2016, Amazon will refund the unused DPD labels sellers print out but cancel prior to shipping. Click Refund Purchased Delivery Label for any unused DPD label within 30 days of the date the order was placed. The label goes into refund pending status until 45 days after the day the order was placed, when the charges are refunded to your registered bank account.

Melanie takes an active interest in all things Amazon. She keeps an eye on the latest developments, and keeps Amazon sellers up to speed.