Q3 is just around the corner, and Amazon has countless tools, features, updates and policy changes in store for sellers. From webinars to price parity requirements, Q3 has the makings of a very busy quarter for both Amazon and merchants. So, let’s have a look at what lies ahead in the second half of the year.

1. Enroll for Two Step Verification By June 30

Sellers who haven’t enrolled for two-step verification Security feature which involves s... More will no longer be able to access their Seller CentralAmazon Seller Central is a portal or a h... More accounts after June 30. This is especially important for Amazon Lending account holders, who are being urged to sign up by the end of the week. For signup instructions, please read our previous post.

2. Sponsoring Enabled for Jewelry

Amazon now enables sellers to advertise jewelry products using the Sponsored ProductsPay-Per-Click (PPC) ad platform for Amaz... More feature. Existing advertisers can add jewelry products to their ads list using the CampaignSellers and vendors have a variety of ad... More Manager tool under the AdvertisingAdvertising is a means of communication ... More tab in SellerCentral, as seen in this demo video.

3. Amazon Webinar on June 30

The ‘Getting Started with Amazon Sponsored Products’ webinar will be taking place on June 30 at 11:30 am, GMT. Register here, and learn how to set up your campaigns and make the most of the Sponsored Products feature.

4. Amazon to Collect GST from Australian Sellers

Starting July 1, sellers who are residents of Australia and are not registered for GST will be charged 10% more for selling on Amazon. The Australia Goods and Services Tax (GST) is levied by the local government on non-resident organizations providing remote services, such as Amazon.

Australian sellers who are already registered for GST will not be charged if they provide their Australian Business Number (ABN) to Amazon by June 30, 2017. All others will see a 10% increase to the Selling on Amazon fees. This also applies to companies using Amazon Web Services.

To provide your ABN, go to Account Info > VAT Information > Add New VAT/GST Registration Number. Select Australia from the drop-down list, enter your ABN, and click Save.

5. Referral Fee Discount for Apple Hardware on Amazon.de

Amazon.de sellers will enjoy a referral fee discount for iPads, MacBooks, iMacs, Macs, iPods and Apple Watches. They will pay 5% in referral fees, rather than 7%, for all products sold until 31st October 2017.

Note: the discount does not apply to iPhones

This discount will apply automatically. It will be recorded in the Referral Fee Discount line of the Transaction Details report. To qualify for this limited-time offer, the Apple hardware must be listed in the correct categories and browse nodes.

6. FBA Accepts 34oz. Liquids in Glass Containers

Sellers may now list and fulfill orders via FBA for liquids in glass containers that weigh 4oz. to 34oz. (113ml to 966ml). To qualify, the products must feature double-sealed screw caps, be packed in corrugated boxes, and pass a 3-foot drop test.

7. Price Parity Waived on Amazon JP

Amazon Japan removed parity provisions for sellers who also use other sales channels, and any reference to parity has also been removed from the Help pages. It will no longer enforce price parity on other channels. In other words, Japanese sellers are free to charge more for items listed on Amazon than they do on other websites.

8. Amazon Partnered Carrier Offers B&W Shipping Labels

Sellers on Amazon JP can now print their Partnered Carrier shipping labels in black and white. The change also applies to printable vouchers. Campaign details are available here.

9. New Requirements for Organic Food Products in Europe

Organic food sellers have been asked to provide their Organic Certification to Amazon since the beginning of the year. Starting June 20, sellers who haven’t been given Amazon’s approval to sell organic products have had their listings removed.

For more information from your local Control Bodies in Europe, please use the contact details available here. If you don’t sell organic products but have had your listings disabled anyway, please check your titles or descriptions for keywords like ‘organic’ or ‘bio’. The guidelines are available here and here.

10. New Hazmat Labelling Rules for European Sellers

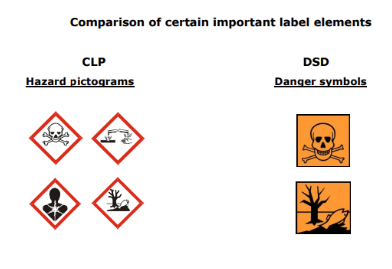

All products sent to FBA warehouses across Europe must now comply with the European Regulation (EC) No 1272/2008 on classification, labeling, and packaging (CLP), as set out in the Dangerous Preparations Directive (DPD).

Note: CLP warning labels are red diamonds, while DPD/DSD warning labels are orange squares. DSD complements the DPD directive but only applies to pure substances (not mixtures).

Amazon will henceforth reject items with DPD symbols (the orange square pictograms). All new items received by fulfillment centers with this label will be registered as ‘Unsuitable Units’, and any existing inventory will be deemed ‘Unsellable’. If there are no removal requests within 30 days, Amazon will dispose of these units automatically.

11. Extra Info for FBA Hazmat Listings

Amazon now asks for additional information when you list or convert your listing for certain items from MFN to FBA. You will need to enter it every time you convert with the Manage Your Inventory or via the Amazon Marketplace Web Services tool, or list using the Add Products Via Upload template. Existing listings will not be affected.

There are two types of products that qualify, and you’ll need to provide the following information:

- Products that are or include batteries. Mention the composition (alkaline, lithium ion, lead acid, nickel cadmium, etc.) and the number of units, along with some other information printed on the battery or available from the manufacturer.

- Hazmat (personal care products and household goods, such as perfumes, cooking sprays or cleaning products that contain corrosive or flammable substances and aerosols). Mention specifications that indicate their flammability and corrosiveness, and provide the UN number and a range of other characteristics found on the Safety Data Sheet.

12. Better Photo Editing Tool

The built-in Amazon Seller app tool that helps sellers capture and upload product photos in a flash, the Portable Photo Studio, has been around for the better part of a year. Yet, not many sellers use it. To make up for lost time, Amazon recently announced that it has made some improvements to it. To see the Portable Photo Studio in action, please watch this video demo by Jungle Scout (please scroll to 2:15).

13. Complete VAT Calculation Report

As of June 14, 2017 sellers can view and download their VAT invoices using the VAT Calculation Report in the Tax Document Library. The invoices are available three days after shipping an order. To enjoy the free automatic VAT invoicing feature, please enter your tax information in Seller Central and activate the VAT Calculation Service.

14. New Account Health Dashboard

You can now review and compare your performance with current selling targets and product policies on Amazon using the Account HealthAccount Health is an Amazon page which c... More dashboard. It will notify you when listings are removed for violating product policy. Your Account Health dashboard can be found under the Performance tab in Seller Central.

15. Customized Inventory File Templates

You can now create personalized inventory templates, uploading and updating your inventory files in bulk more easily. Amazon allows you to enter listing information for as many types of products as you wish, whatever the category, using just one template.

16. Amazon Rolled Out a Newsletter

The new Amazon Seller Newsletter was launched last month, and all Professional Sellers will be receiving it from now on. The first edition can be accessed using this link, and we expect that all future editions will be available at the same URL. Simply change the number at the end (‘ed1’) to whatever edition you’re looking for (‘ed2’ for the second issue, ‘ed3’ for the third, etc.).

17. “Sold, Ship Now” E-mail Changed

You may have noticed that your Sold Ship Now emails have changed from text to HTML format. In case you were wondering what that means, it’s just an upgrade to a better-looking layout, with different fonts, links, and even graphics.

July is sales tax month! As such, we are organizing a Sales Tax 101 Webinar for Amazon FBA Sellers.

Find out more and register for the webinar below