This is a guest post by Jennifer Dunn at Tax Jar

If you’re reading this, you’re probably an eCommerce seller. That means you already know you have to charge sales tax in states where your business has sales tax nexus. What you may not know is that approximately one-third of states consider shipping charges taxable, too. That means if you charge your customers for shipping, you may be required to charge them sales tax on that shipping charge.

Let’s dive into a few general exceptions and sales tax rules to keep an eye on. The key thing to keep in mind here is that since U.S. sales tax is governed at the state level, there are no universal truths when it comes to how sales tax may or may not apply to shipping charges. Your best bet is to always contact your state’s department of revenue or a vetted sales tax expert when you need clarification.

Sales Tax on Shipping, 101

Sales tax is governed at the state level, meaning that each U.S. state makes their own rules and laws when it comes to sales tax. One thing that states differ on is whether or not retailers are required to collect sales tax on the shipping charges you charge to your customers.

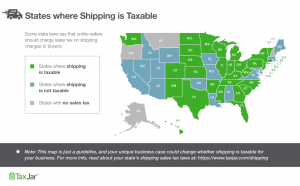

Here’s a map showing (in general) which states require online sellers to collect sales tax on shipping, and which do not.

Some states require sales tax on shipping, and some don’t. Most states, however, have specific scenarios where sales tax on shipping is and is not required. Let’s dig in:

Sales Tax on Shipping Exceptions

- If some of the items in the shipment are non-taxable

Most of the time when an item isn’t taxable you don’t charge sales tax on shipping for that item. For a single-item order this is pretty straightforward, but it gets complicated when you start combining taxable and non-taxable items within the same order. Most states rule that in that case you’ll need to charge shipping tax only on the portion of the shipping charge that applies to the taxable products by price or weight.

For example:

You sell a board game for $50 and a hoodie for $50 in a state where shipping is taxable and clothing is tax exempt. Since the hoodie is tax exempt, you’ll need to figure out how to only tax the portion of the shipping that applies to the board game. You can choose to charge sales tax on half the shipping charge (since the game is half of the items in the shipment) or you can weigh both items and charge the sales tax based on the amount of shipping that would apply. If the board game is 6 lbs. and the hoodie is 4 lbs., you would charge sales tax on $6 out of the $10 shipping charge.

- If you’re delivering items in your own vehicle

Most state laws on shipping normally apply to common carriers like UPS, USPS, and FedEx, but a handful of states like Maine have laws that state shipping charges are non-taxable if delivered by a common carrier, but taxable if delivered in the seller’s own vehicle. If you do a lot of local deliveries yourself, you should definitely check out if your state is one of the few with this law.

- If the item is available for pickup

On a related note, most states rule that a shipping for an item is taxable unless a customer can come to your location and pick up the item at your business. In that case, the shipping is not seen as a necessary part of the sale and therefore not taxable. Your mileage may vary by state; Illinois went back and forth on this ruling for years until they finally decided that shipping was taxable for e-commerce orders there.

- If other charges (handling) are bundled in with shipping

Many states like Maryland and Virginia have laws where the shipping itself isn’t taxable, but if shipping and handling charges are combined, the combined “shipping and handling” charge is taxable even if it’s a separate line item from the products.

A few states like California rule that shipping is not taxable but “handling” is always taxable. Again, your best course of action is to contact your state’s department of revenue to make sure.

Wrapping it all up

You may have gotten our not-so-subtle hint that you should always check with the state to determine if shipping is taxable. Like we said up front, there are no universal rules; every state gets to make their own rules on what is or isn’t taxable. We recommend that you start out by comparing this list of states that require sales tax on shipping with the states where you’re required to collect sales tax and see what (if any) exceptions may apply to your business.

Hopefully, you have a much better understanding of sales tax on shipping than you did a few minutes ago! If you have any questions, feel free to start the conversation in the comments below.

TaxJar is a service that makes sales tax reporting and filing simply for more than 10,000 online sellers. Check out our new AutoFile credits and AutoFile your sales tax returns in every U.S. state! Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!