Are you baffled by sales tax? Today we’re going to help you start making sense of it by defining the terms and phrases that are the most commonly used when talking about this type of tax.

Keep reading to boost your tax vocabulary. And over the next few weeks, we’ll keep talking about this, with the help of our friends from TaxJar.

A Simple Definition

Let’s start very simply. Sales tax is a tax imposed by state or local governments at the point of sale. It is generally collected by merchants and remitted to the state’s taxing authority. The amount of tax charged often includes state and local (county/city) rates.

Sales Tax Nexus

This is significant enough “presence” in a state, where the state can require a merchant to comply with state sales tax laws.

This presence can include an office, inventory in a warehouse or an employee. Each state defines sales tax nexus slightly differently.

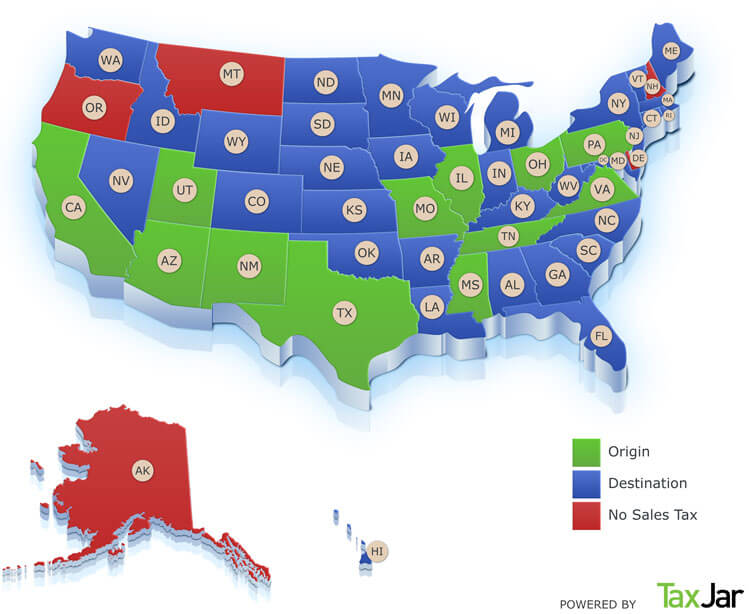

Origin vs. Destination Based Sales Taxes

Origin based: States that requires merchants to charge sales tax based on the rate at the seller’s location.

Destination based: States that requires merchants to charge sales tax based on the sales tax rate at the buyer’s location.

Get a Permit

States with sales tax require that merchants apply for a sales tax permit before charging the tax to customers. Many states considering charging sales tax without a permit to be a crime.

State Taxing Authority

In the U.S., sales tax is levied by individual states. The arm of state government that generally administers matters related to sales tax is the state’s taxing authority.

They are often called the “[State] Department of Revenue” but may also have other names. For example, the authority in charge of this in California is called the “California Board of Equalization.”

Pass-through Tax

Any tax, such as sales tax, that is collected by a merchant but then passed on to a 3rd party, like a state taxing authority. This tax “passes through” the merchant’s control, but they do not get to keep the funds.